For businesses and individuals in Australia, the availability of cash is crucial for many, as they say, cash is king, and thus, these businesses require instant access to credit. Be it for medical help, an undisputed vehicle repair, or even a home emergency knowing where ideally to seek instant cash loans is very important; in Australia, multiple service providers offer quick loans to suitable or eligible candidates so as to make the process smooth and efficient.

Lenders in Australia are commonly attributed and associated with low credit checks and even systems in place that don’t require checks. This has become common, seeing that a lot of Australians require these services, and repaying them is not as difficult as people tend to think. It is of paramount importance to seek reputable lenders who will assist you in an instant without any stress attached to it.

So, if you are a student on AUSTUDY and need help with cash or on Centrelink and need access to funds, this guide will help you facilitate your needs. A huge Thanks to these Aussie lenders one can efficiently and in moments get instant cash. Moving on, let’s take a look at the aspects that these lenders take into account and how they can help you.

Read: Myfastbroker Mortgage Brokers: Your Definitive Guide to Home Financing in the USA

What is Instant Cash?

A “cash loan” is a small, quick personal loan that has a simplified application process and offers rapid funds to the successful applicant. These loans are unsecured and do not require collateral. The eligibility of these loans is determined by current income and repayment capability, not credit history or collateral.

The 10 Best Instant Cash Loan Providers in Australia

Let us understand what are the different primary requirements eighty instant cash loan providers in Australia have. Each such provider has its distinguishing feature that is meant to aid the customers with relatively instant access to funds.

1. Fundo Loans

Fundo Loans are taking root in Australia, for they allow an easy process of obtaining instant cash loans. This is because one requires only a few minutes to apply for a loan, and this suits those people.

One outstanding thing about such companies is the assistance from them, whether it is instant cash loans, no credit checks or as little as a $500 to $5,000 loan instant approval; such companies have diverse options for diverse financial needs. Their internet site enhances the banking process. One should not waste much of their time filling in forms because one can do that online from the comfort of their house.

In addition, such borrowers do not worry about deposits since all terms are known clearly without any extra costs needed, which helps lend money. Most of the customers who borrow from Fundo Loans claim they are satisfied with the instant payout, which is always helpful and essential at the right time.

Why Choose Fundo for Instant Cash Loans?

Fundo provides fast access to funds.

- Flexible Terms of Repayment: They offer loans that can be paid back within a maximum 180-day period, giving you enough time to recover.

- Transparency At Its Best They believe that what you see is what you pay!

- Easy Application Process: You can fill out their application quickly and easily.

- Support Personalised: Their team of dedicated professionals is available to assist you in your loan journey.

Fundo’s cash loans are available to help you with any financial situation, whether it’s an emergency or a planned project. These loans are perfect for unexpected expenses or repairs. They’re not suitable for consolidating debt.

Apply Quickly and Easily

Fundo is easy to use.

- Use the online form to apply.

- quick assessment.

- Get your funds as soon as 60 seconds following approval!

Fundo will help you in a timely manner.

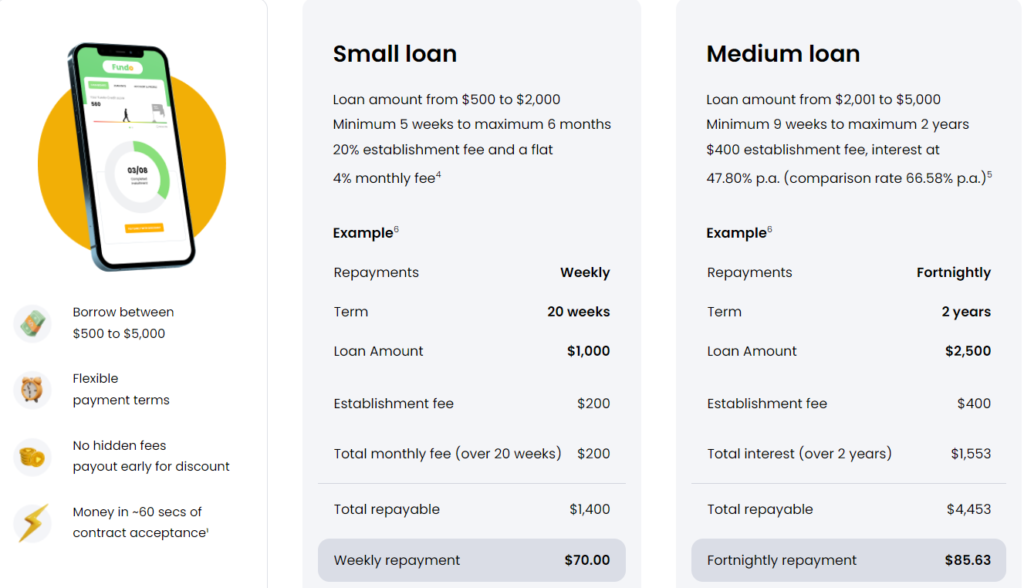

Fundo Loans Example

2. Cash Direct Loans

In Australia, Cash Direct Give Loans from $200 to $5,000 and have found their stronghold because of the speed and simplicity of how one is able to apply. Strategic in nature, they only work with cash loans which can be requested online for people needing funds instantly.

They have, however, set up a system that has integrated Customer service with cash flowing operations as a priority. They will give all the necessary comprehension and feel safe to make all the needed steps to sign the loan. Choosing repaying terms enables customers to select conditions with which they are comfortable. It is more friendly with the people who might have missed their expected or standard expenses or requirements.

They have a plan to widen the working opportunities of Cash Direct Loans while not increasing the redrawing infrastructure that many Australians fear will negatively affect their credit ratings. The essence of the strategy is to help people financially by providing some urgent requirements at the same time.

What is a Centrelink Cash Loan

Small Centrelink loan amounts can range from $200 to $2,000 if you have regular Centrelink income in your nominated bank account. They can loan up to $2000 if your Centrelink income is regular and validated. Otherwise, you can borrow up to $1,000. Customers with a history of good repayment can get a loan up to $2000 backed by Centrelink Benefits.

Read: USAA Career Starter Loan Opportunities

Why choose Cash Direct Loans

Simple: There is no need to worry about paper waste with the digital signature and their simple online process.

OSKO payment in 60 seconds: Sign up online to make a quick decision. We can deposit the money into your account within 60 seconds with OSKO Instant Payment.

Cash Direct membership is free. If you have a Cash Direct account and a history of good payments, you may be eligible to apply for the Express Cash Direct approval process. There’s always a way out in times of need.

They Provide Small Cash Loan

| TV Loan & Computer Loans | Dental Loan & Medical Loans |

| Small Car Loans & Car Repair Loan | Holiday and Travel Loan & Household Loans |

3. Fundency Loans

In the area of emergency cash loans, Fundency Loans has a distinguishable presence in Australia. Quick access to cash makes them a common choice for those in times of need. An important benefit is their uncomplicated application process. They can easily click a button online and almost immediately obtain a qualification. Such an evaluation process is vital in situations when time is scarce.

Yet another appealing feature is their relatively low baseline lending criteria. Fundency is receptive to multiple financial conditions, such as those receiving Centrelink benefits as well. This feature adds accessibility to many Australians in getting the assistance they require.

Outreach and customer service is what differentiates them from other market players. Various customer representatives are able to answer a range of issues or questions before and in the course of taking out the loan. Fundency respects the copyholder’s need for clarity and thus explains everything with regard to the obligations the applicant assumes. It is about protecting the applicant’s interests as well as providing her with financial assistance in the most difficult times.

Why Choose Fundency Loans

- Paperless Application

- Budget-Friendly

- Easy Automatic Repayments

- Direct Money Transfer

4. Quickzy Finance Loans

Outstanding for its user-friendly approach to instant cash loans, Quickzy Finance Loans is a very popular choice among Australians. With simple clicks on their keyboards, hundreds of borrowers can fill out online application forms instead of wasting time and energy on the papers.

This provider is able to provide a range of loan amounts to help meet different kinds of needs. If you are looking for a small loan, or a large one, Quickzy has a solution adjusted to your needs. Apart from that, Quickzy Finance Loans tends to have instant cash loans with approval rated high for those who do not have an excellent credit score. This facility helps lots of Australians during bad times when they are looking for some help.

Customers who have dealt with them say that the customer support is prompt and friendly, which makes it easy to borrow.

Why Choose Quickzy Finance Loans

- The loans will be sent directly to your account regardless of the bank you use

- Take out a fast, easy personal loan up to $5,000 today and start rebuilding your credit score.

5.Cashn Go Loans

Cashn Go Loans is in its niche as one of the leading Australia cash loans instant online in Australia. Borrowers can look forward to quick funds with the application process being easy and not a lot of waiting around. This option has a great advantage for people who have had difficulty with their credit but still need to get a loan.

Cashn Go: Overview and Features

Payment processing services continue to evolve to meet current societal requirements. An example is Cashn Go. One other factor that makes Cashn Go more appealing is the Cashn Go payout structure. They proffer customized responses to the Cashn Go application whether one is on Centrelink or is just interested in immediate payment.

Where a customer is using their service they offer the ability to easily apply without leaving one’s house through their online platform. Many people expect instant payments and this means they should apply for loans according to their devices.

As with any other person who opts for borrowing, concerns like communication between the lenders and myself are important. This ensures clear communication between the wearer and the drawer and offers peace of mind for all participants at every stage between Cashn Go and myself.

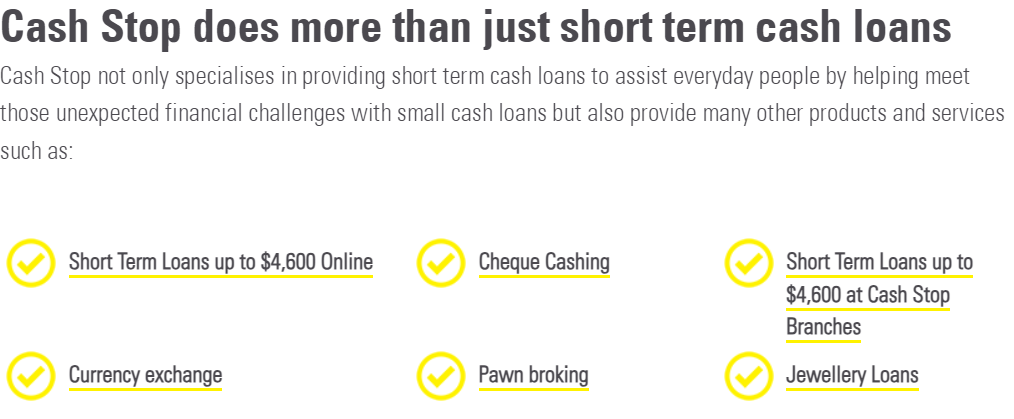

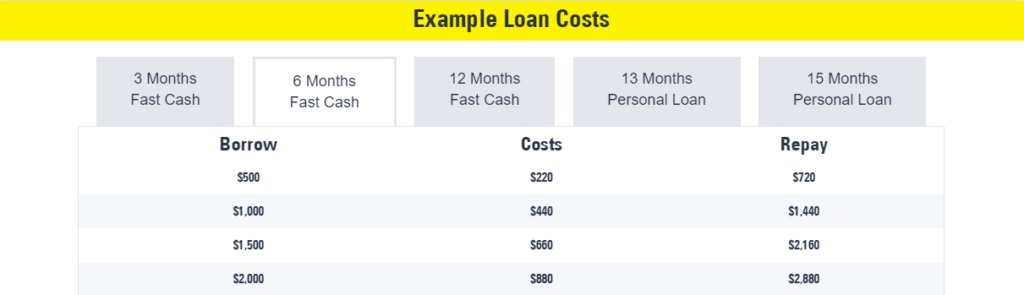

6. Cash Stop

Cash Stop is recommended for all Australia’s seeking instant cash. Fast and times efficient application and approval processes allow many borrowers to get their funds with ease. One other standout feature of Cash Stop that every cash hoarder would appreciate is their customer support efforts. In most cases, they require you to go through different phases of loan applications, including terms and conditions.

One other that distinguishes them from from others is the ease in terms within which the offered cash can be returned. Petty expenses are, in most cases, covered, hence, an urgent need for cash would not be a problem anymore due to the available options many sellers offer to clients.

For those people who are benefitting from Centrelink payments, hop on your Cash Stop loan applications, as this is a money lender that you can count on. Many loan lenders fail to have the same inclusive approach to different societies and their members. Cash Stop is indeed convincing on the list of instant cash loan providers in Australia for anyone needing cash instantly without much trouble.

Why Choose Cash Stop?

- Cash Stop is a leading provider of online cash advances, loans and fast cash. We have been in business since 2000. Cash Stop’s 22-year history of outstanding customer service means you can rely on us to be there for you when you are in need.

- Quick turnaround from the application to approval.

- Trusted and responsible credit provider, with long-standing experience.

- When you need cash, there are real people who can help.

7. Gday Loans

Gday Loans is a perfect fit for rapid cash loans due to the fact that it sets itself apart in the fierce market competition. Their technology incorporates a highly accessible and user-friendly environment for those seeking to apply for a loan.

Gday Loans’ clients are able to fund their accounts within hours after making the application as they ensure a reasonable turnaround time for the processing. Where medical emergencies or unexpected payments are concerned, such immediacy is essential.

This also makes the Gday Loans stand out because they have wide and flexible lending requirements. They are able to approve many borrowers, including those receiving Centrelink payments. This is convenient for many Australians who would like to borrow a credit loan in a matter of minutes without any credit checks, or filling out multiple forms.

Gday Loans also have good customer service. Their clients can contact them any time without any limitations providing borrowers with assistance when applying for the loan and even during the loan repayment period. Their devotion to satisfying the needs of their customers helps them to create trust and dependability in what they offer.

Why Choose GDay Loans

- Best short-term lenders in Australia ready to approve your loan application.

- Gdayloans.com.au is a collection of Australia’s finest short-term lenders. They are all ready to approve loans.

- Five minutes of your precious time and just a few clicks will get you the cash loan. G’day Loans is the place to go if you’re in need of a personal, secured, or unsecured loan.

- You will be put in contact with lenders that can accept, approve and pay your loan immediately. No waiting, no paperwork and no nail-biting as decisions are made. Our entire system is set up to help you get cash quickly.

8. Cash Smart Loans

Cash Smart Loans have a short and straight forward way of applying for a loan in Australia. Their main selling factor is fast approvals, which make cash smart loans highly recommendable to people with cash emergencies.

The usernames chosen by borrowers intended to be good borrowers and open an account at Evolve have been mentioned at an earlier time in the report, and they include Sukuma, Yiil and Kabir. Their Cash Smart Loan Evolve process requires user verification, which is easily done online. They take on average, five to ten minutes to fill and submit all required forms, which is quite convenient, avoiding all the hassles of waiting around for necessary documentation.

Their processes are also quite straightforward in that their cash loans do not have any paperwork requirements, which consider them to be ideal for borrowers even those who have bad credit scores.

Their online processes have also eased the burden, but the granted weight order of cash loans is what lent their services ideal as they gave extremely broad requirements with no overly strict guidelines. They also have a very flexible cash policy, which means they can easily issue cash even to those on Centrelink with fifteen dollars aside before losing the coverage.

With cash smart loans, a vice manager will be in touch with the borrower and discuss any major concerns waiting to be voiced. It could take many more weeks and uncertainties to find a better bilateral barcode for themselves.

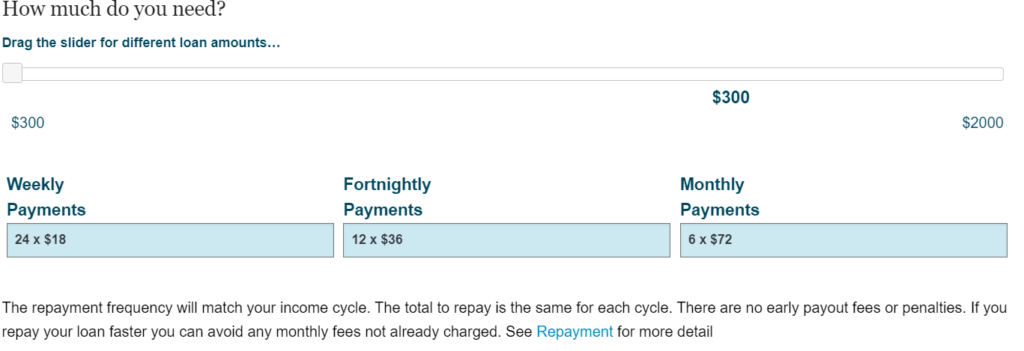

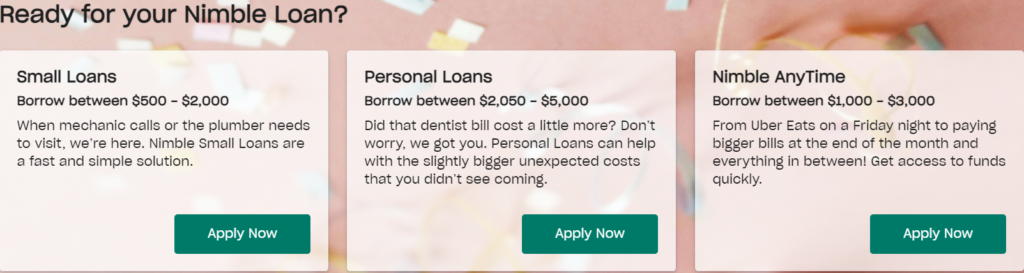

9. Nimble Loans

Nimble loans define strategies that specifically integrate all available offers. This Michael cosmically flexible loans fashion kingdom assists anyone in dire need of cash as a loan, especially for medical expenses or rehabilitation. Customers will especially appreciate their service as the wait times will be reduced significantly, leading them to be able to minimize drawbacks. Applying to a loan source would help out so much and greatly minimize or rather remove having to deal with the traditional aspects of applying.

Nimble loans are geared towards the Australian market while earning a niche in the lending market. Dealing with each loan needs to be done to make sure a variety of financial assistance is aimed. To put it even simpler, their process is so convenient that anyone can quickly have access to the funds they require or seek out.

Providing their clients with a greater range of options as they find themselves suffering economically due to family issues, this firm has proved to be effective and useful in addressing family loans. Now if someone had to deal with a situation where the amount required was between $1400 to $1800, they would already know where to go. Borrowers like this honesty all through as there are no surprise additional charges when borrowing.

And for those who are on Centrelink benefits, Nimble also has customized products that assist people in need of urgent cash flow solutions with little or no requirement as well as credit history hindering chances of success.

10. Quick Cash Loans

When it comes to fast cash loans and instant approval, QuickCash is a trustworthy provider. They are aware that life can be full of unforeseen situations that necessitate instant cash. They provide you with quick access to funds, which can allow you to apply for work with little to no delay.

This provider has a customer-friendly approach that is quite flexible. QuickCash provides a range of needs with competitive interest rates and repayment terms that are more suitable for the individual. If you want fast cash loans but, more importantly, want guaranteed instant approval, there is no need to look any further than QuickCash.

For those looking for help with money problems, whether it is an instant cash loan or help during a tough time, they want to provide quick results with full transparency throughout the loan process. Therefore, if you’re looking for a service specifically designed to help with near-instant approvals with no credit checks, you may want to give QuickCash a try, as they may just be suitable for your requirements.

FAQs

Can a person with bad credit get an instant loan?

Yes! CashnGo puts less importance on a person’s credit history than other lenders. They will check your credit rating, so if you are a creditworthy applicant, we will consider it. They are more interested in the current income level of your household and your capacity to repay a loan. They understand that Australians may have poor credit ratings due to circumstances beyond the control of those individuals.

What Are the Eligibility Requirements?

It would help if you were at least: * Over 18 years of age * Earning an income that is steady for at least three months prior to applying. * An Australian citizen or permanent resident * Not in bankruptcy or extreme financial hardship

How do I apply for an Instant Cash Loan?

You can apply online. The whole process can be completed online in a matter of minutes.

When will I receive my money?

CashnGo’s instant cash loans offer the best cash delivery time. After you are approved for the loan, CashnGo will immediately send cash to the bank account that you specify.